Why Choose Michael Marchena as your Preferred Lender Loan Specialist Mortgage Professional

Michael Marchena | Lender with Patriot Pacific Financial Corp

Achieving the dream of owning a home is a significant milestone in realizing your financial aspirations. With my wealth of knowledge, extensive experience, and a range of flexible loan options, I am dedicated to guiding you toward making your homeownership goals a reality. I pride myself on being both adaptable and innovative, ensuring a swift and straightforward mortgage process, even in complex situations.

Whether you’re in the process of purchasing a new home or refinancing your current one, I am committed to:

* Thoroughly explain every aspect of your home loan.

* Maintaining seamless progress throughout each stage of the process.

* Ensuring a prompt journey to the closing table.

I am eager to not only meet but exceed your expectations, earning your ongoing business and referrals through a service level that surpasses any other loan officer in the industry. Your homeownership journey is my priority, and I look forward to assisting you every step of the way.

Contact Home Loan Specialist Michael Marchena Today Call/Text 951-334-3403 or

Start your Home Loan Application Now!

NMLS 2501919 | DRE 01918167

About Lender Michael Marchena

Achieving the dream of owning a home is a significant milestone in realizing your financial aspirations. With my wealth of knowledge, extensive experience, and a range of flexible loan options, I am dedicated to guiding you towards making your homeownership goals a reality. I pride myself on being both adaptable and innovative, ensuring a swift and straightforward mortgage process, even in complex situations.

Achieving the dream of owning a home is a significant milestone in realizing your financial aspirations. With my wealth of knowledge, extensive experience, and a range of flexible loan options, I am dedicated to guiding you towards making your homeownership goals a reality. I pride myself on being both adaptable and innovative, ensuring a swift and straightforward mortgage process, even in complex situations.

Whether you’re in the process of purchasing a new home or refinancing your current one, I am committed to:

- Thoroughly explaining every aspect of your home loan: I believe in clear communication and transparency, ensuring you understand all the details and options available.

- Maintaining seamless progress throughout each stage of the process: From application to approval, I manage every step efficiently to keep everything on track.

- Ensuring a prompt journey to the closing table: My goal is to expedite the process without sacrificing quality, so you can enjoy your new home or improved financial situation as soon as possible.

I am eager to not only meet but exceed your expectations, earning your ongoing business and referrals through a service level that surpasses any other loan officer in the industry. Your homeownership journey is my priority, and I look forward to assisting you every step of the way.

Home Loan Services

Lender Michael Marchena offers a wide range of loan programs.

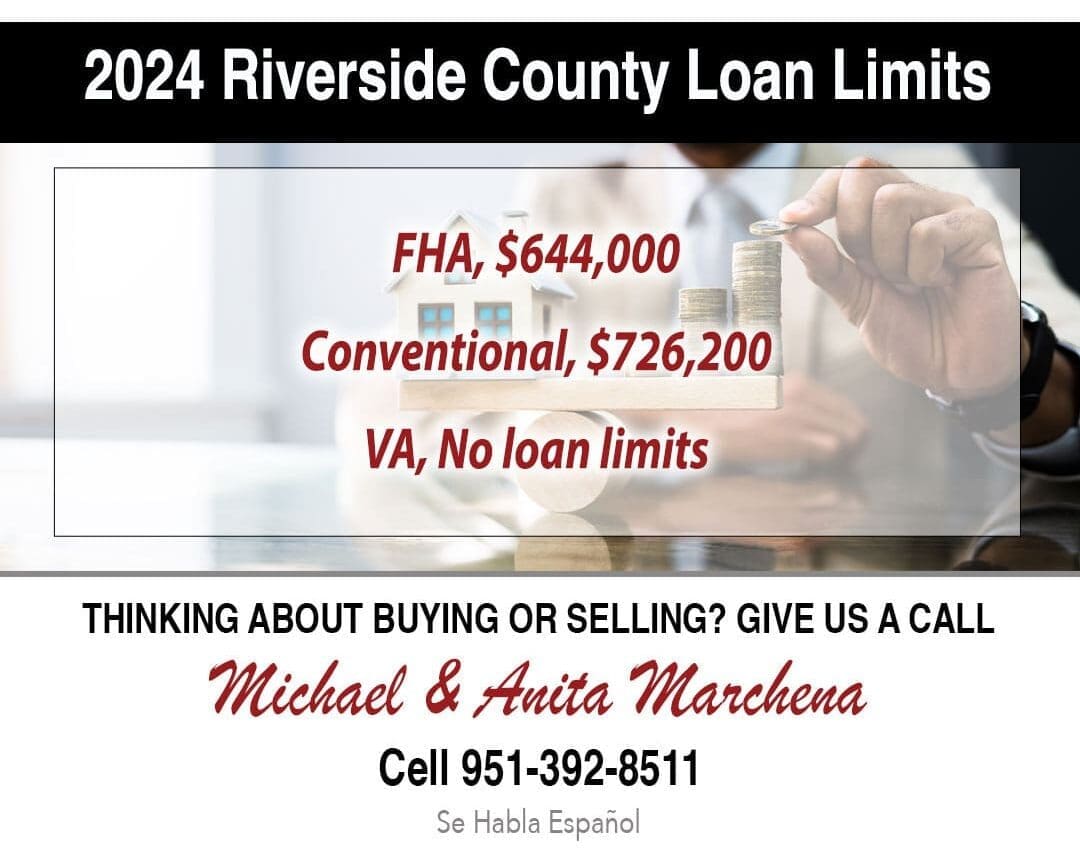

FHA Home Loans

Federal Housing Administration (FHA) loans are government-backed mortgages designed to help first-time homebuyers and those with less-than-perfect credit. With lower down payment requirements and flexible credit guidelines, FHA loans make homeownership more accessible. Borrowers can typically qualify with a down payment as low as 3.5% of the home's purchase price.

VA Home Loans

VA loans are available to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. Backed by the Department of Veterans Affairs, VA loans offer benefits such as no down payment, no private mortgage insurance (PMI), and competitive interest rates. These loans are designed to make homeownership affordable for those who have served our country.

Conventional Home Loans

Conventional loans are traditional mortgages not backed by the government. They typically require higher credit scores and larger down payments compared to FHA and VA loans. However, conventional loans offer competitive interest rates and more flexibility in terms of loan amounts and property types. They are a popular choice for borrowers with strong credit and stable income.

USDA Home Loans:

The United States Department of Agriculture (USDA) loans are aimed at helping low-to-moderate income individuals or families purchase homes in eligible rural areas. USDA loans offer benefits such as no down payment, lower interest rates, and reduced mortgage insurance premiums. They are an excellent option for those looking to buy a home outside of urban centers.

Land Loans

Land loans are used to finance the purchase of a plot of land where the borrower intends to build a home or develop the property. These loans can be more challenging to secure than traditional mortgages because they are considered riskier. Land loans typically require higher down payments and have shorter repayment terms, but they are essential for those looking to invest in undeveloped property.

Refinance your home

Refinance loans allow homeowners to replace their existing mortgage with a new one, often with better terms. Refinancing can help lower monthly payments, secure a lower interest rate, convert an adjustable-rate mortgage to a fixed-rate, or access home equity as cash. It's a valuable tool for improving your financial situation and making homeownership more affordable in the long term.

Down Payment Assistance Programs

Down Payment Assistance (DPA) programs provide financial aid to help homebuyers cover the down payment and closing costs associated with purchasing a home. These programs are typically offered by state and local governments, non-profits, and community organizations. DPA programs are especially beneficial for first-time homebuyers and those who might struggle to save enough for a down payment, making homeownership more attainable.

Why choose Michael Marchena as your Home Loan Specialist?

Extensive Knowledge and Experience

With years of experience in the mortgage industry, Michael Marchena has a deep understanding of various loan products and the intricacies of the home financing process. His expertise ensures that you receive informed advice and tailored solutions that best fit your financial situation and homeownership goals.

Personalized Service and Clear Communication

Michael prides himself on providing personalized service to each client. He takes the time to understand your unique needs and circumstances, offering clear explanations of every aspect of your home loan. His commitment to transparency and open communication ensures that you are well-informed and confident throughout the process.

Flexible Loan Options and Innovative Solutions

Whether you’re a first-time homebuyer, a veteran, or looking to refinance, Michael offers a wide range of loan options to meet diverse needs. He is adept at finding innovative solutions, even in complex situations, to ensure a smooth and efficient mortgage process. His adaptability allows him to cater to a broad spectrum of clients and financial scenarios.

Dedication to Client Satisfaction

Michael’s ultimate goal is to exceed your expectations and earn your ongoing business and referrals. He is dedicated to making your homeownership journey as seamless and stress-free as possible, from the initial consultation to closing. His commitment to exceptional service and prompt processing sets him apart from other loan officers in the industry.